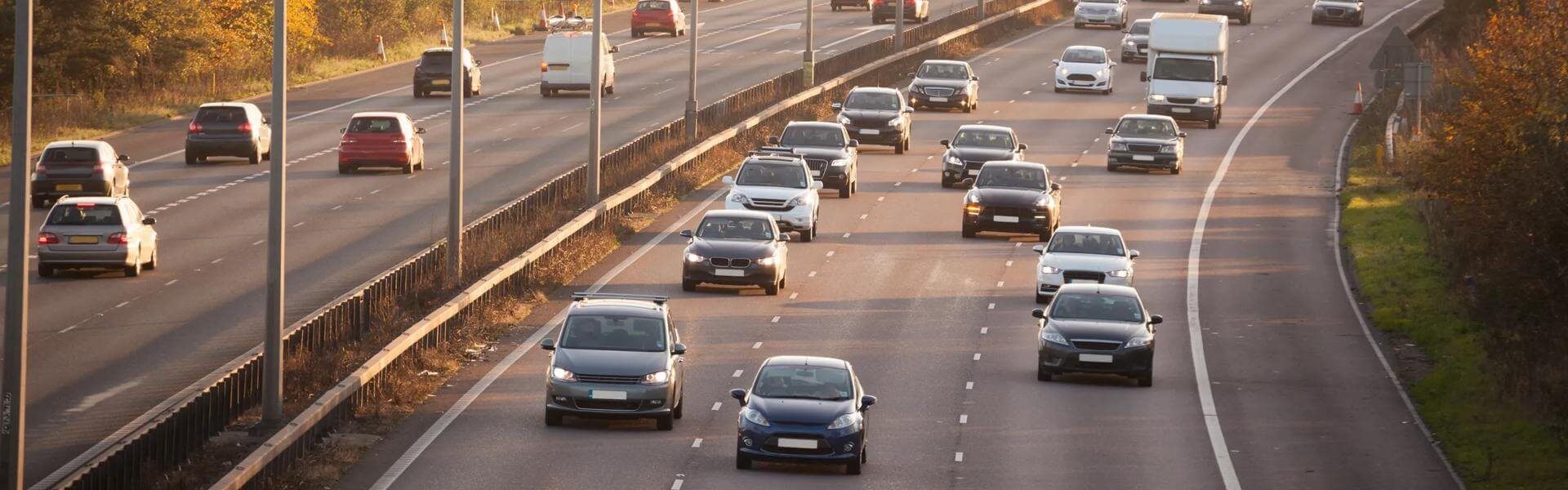

Reinsurer Swiss Re has published its Motor Bodily Injury Landscape Report 2025 which examines injury trends across 15 European markets.

The findings highlight a clear and consistent rise in claims costs, driven by inflationary pressures, evolving legal frameworks and the increasing cost of care (reflecting wage growth and shortage in healthcare professionals). Clearly these rises have a knock on effect on the profitability and sustainability of motor insurance business across the continent.

Motor Insurance Directive

The Motor Insurance Directive is EU law which provides that anyone who holds a compulsory motor insurance policy in an EU country is covered to drive throughout the entire EU. This directive:

- obliges all motor vehicles in the EU to be covered by compulsory third party insurance,

- abolishes border checks on insurance, so that vehicles can be driven as easily between EU countries as within one country,

- specifies minimum third party liability insurance cover in EU countries,

- specifies exempt persons and authorities responsible for compensation,

- introduces a mechanism to compensate local victims of accidents caused by vehicles from another EU country,

- requires claims about accidents in an EU country other than the victim's country of residence to be settled quickly (so-called visiting victims), and

- entitles policy holders to request a statement of any claims involving their vehicle, which were covered by their insurance contract, over the last 5 years.

The directive does not regulate:

- issues of civil liability and the calculation of compensation awards – these are decided by individual EU countries, and

- optional or so-called comprehensive cover (for physical injury of the driver, material damage to vehicles, vehicle theft, etc.).

Key findings and predictions

The report states that:

"Care cost is the most important driver in countries showing the highest levels of compensation.

"The costs of health and medical care for people who have suffered bodily injury in a vehicle accident are expected to continue to increase, particularly in regions where medical personnel shortages are expected to intensify."

Apparently Germany and the UK report that health and medical staff shortages are increasing cost pressures.

The report predicts that bodily injury claims severity is expected to accelerate in Europe due to rising wages, higher healthcare expenses (especially in countries with an aging population) and inflation.

The report finds that vulnerable road users and drivers on rural roads remain the most exposed and that:

"Policymakers and insurers will need to focus on targeted, evidence led interventions if Europe is to meet its road safety targets."

The report finds that drivers under 25 carry the highest risk due to their lack of experience and greater likelihood of risk taking.

The EU's directive on driving licences aims to reduce the number of collisions on EU roads and to cut undue burdens on citizens and authorities relating to administrative procedures. The directive includes:

- the introduction of digital EU driving licences,

- an EU wide accompanied driving scheme for 17 year old drivers,

- a probationary period for novice drivers, and

- introduces new requirements on physical and mental fitness to drive.

What does this mean for the insurance industry?

For insurers, measures which are taken to increase safety on public roads (including reduction of speed limits) have a causal effect on the number of collisions and therefore numbers of claims made.

Whilst in-built car technology and developments to improve safety are expected to reduce the number of claims, the costs of claims when made are nevertheless predicted to rise.

This begs the question as to whether driverless cars are the future for a sustainable motor insurance market but that comes with a whole other level of complexity for the market.