Banking and finance

We operate a full-service banking and finance practice with extensive experience in acquisition finance, real estate finance, restructurings, refinancings, project finance, asset-based lending and general finance on a bilateral, club and syndicated basis.

The team are known for giving practical advice, having strong market knowledge, being easy to use, proactive and prepared to give a view. We resource all our deals with senior people which differentiates us from our competitors.

We are panelled with a large number of leading banks which reflects our high standing as a mid-market banking and finance practice. This includes HSBC, NatWest, Santander, Investec and Virgin Money and as the debt market has evolved, we have joined the panel of a number of alternative debt providers including Beechbrook Capital, Shawbrook, BOOST&Co, OakNorth, ThinCats and BREAL Zeta CF.

We also act for UK and international corporates of all sizes from high growth companies to FTSE 100 companies, institutional investors, entrepreneurs and management teams. Our strong government sector offering means that we are also one of the UK’s leading advisors to local and central government bodies.

We advise on a broad array of transactions.

"The cross-collaboration between the banking team and the broader corporate team is seamless."

Key banking and finance law areas

Asset finance is an area where clients need ongoing advice. We advise on HP and finance leasing, including advice on borrowing base formulae and certificates and intercreditor and debenture waiver arrangements with other lenders.

Trade, asset and receivable transactions require a specific skill set within banking and finance and we have invested a significant amount of time upskilling all our team in this area. Shaun McCabe and Graham Ball have particular expertise in this area.

The banking and finance team capitalise on the firm’s unique independent and public healthcare offering. Our unrivalled ability to provide sector-focused transactional, property and regulatory advice, which is led by Emma Hinton, means that we win repeat work from funder and borrower clients in this sector.

Transactions in the health and care sectors represent 30% of the transactions our banking and finance team acts on and a large percentage of these are private equity transactions. We are able to access expert lawyers from around the firm to provide commercially focused and relevant advice to help protect lenders into the sector considering the landscape of changing policy and regulation.

The independent healthcare team won the Private Legal Adviser Award at the LaingBuisson Awards in November 2021 which is a testament to our commitment and expertise in this area.

"Browne Jacobson has an experienced team with the ability to deal with the time constraints and demands of event-driven transactions."

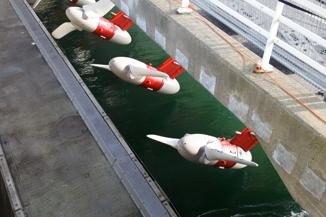

Our banking and finance partner, Paul Hill, leads in this area and has strong connections and capability having advised on many of the largest and most complex national and international transactions in this sector. Coupled with the extensive experience of our energy, government, construction, public procurement and corporate teams, we offer clients a strong fully packaged service. We have an impressive workstream in this area, including advising on some of the highest profile infrastructure acquisitions in the UK market.

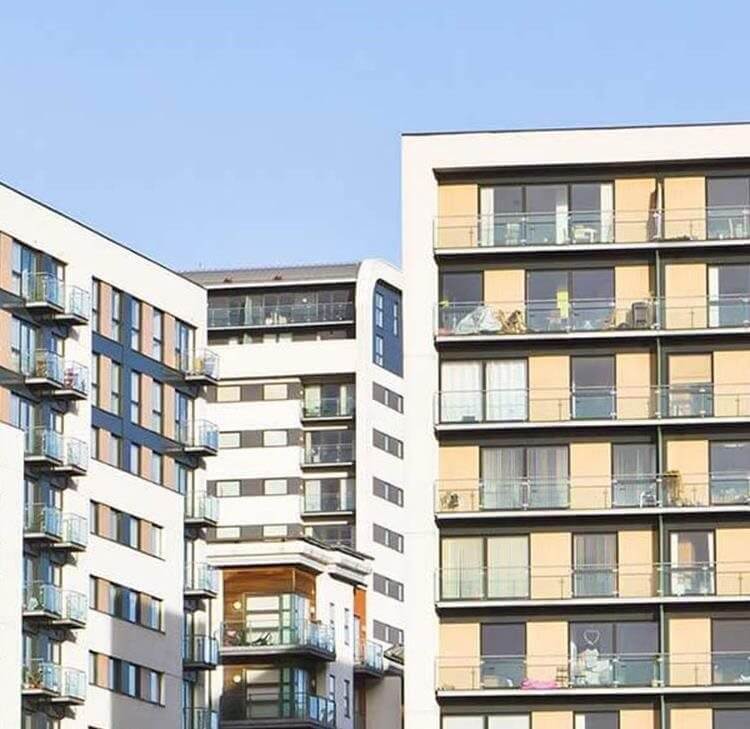

Real estate finance (both development and investment finance) is a large part of our practice which is headed up by Mark Lewis.

Mark and his team are dedicated solely to real estate finance so are able to offer very tailored and practical advice. Recently, we’ve been particularly active on funding transactions in the residential housing sector including for Homes England and Wise Living. Homes England are a key client, and we advise nationally on its Home Building Fund which provides development finance into the residential housebuilding sector.

We also act for a large number of retailers (including Boots, Morrisons and 99p stores), niche retailers, luxury brands, designer labels and cosmetics companies on a variety of matters including real estate, property portfolio management and property and corporate acquisitions.

The team have carved out a niche advising on hotel transactions – and as a result have very strong and up-to-date understanding of the key issues affecting funding in this sector, including banks’ approach to hotel funding (i.e. profitability focus over LTV), overseas buyers, franchise agreements and non-disturbance agreements.

"A highly personable team. Enjoyable to work alongside whilst also carrying out work in a professional and highly competent manner. Communicate well throughout a transaction and the depth of team means that there is always someone to pick up work to meet tight timescales when required."

We regularly advise on acquisitions, cash-out transactions, development capital financings, project finance and private equity transactions. We also have an impressive client base in this sector which gives us strong visibility of the local market.

We have genuine depth of experience in acting on private equity transactions for banks, private equity houses and management teams completing numerous recent high-profile deals. We work closely alongside our market-leading private equity specialists to deliver these transactions with a true understanding of the market in which our clients operate. We are well known for our commercial and pragmatic advice and our added value derived from the wealth of our deal experience. We were named Regional Legal Adviser of the Year at the 2021 European Private Equity Awards.

Asset finance is an area where clients need ongoing advice. We advise on HP and finance leasing, including advice on borrowing base formulae and certificates and intercreditor and debenture waiver arrangements with other lenders.

Trade, asset and receivable transactions require a specific skill set within banking and finance and we have invested a significant amount of time upskilling all our team in this area. Shaun McCabe and Graham Ball have particular expertise in this area.

The banking and finance team capitalise on the firm’s unique independent and public healthcare offering. Our unrivalled ability to provide sector-focused transactional, property and regulatory advice, which is led by Emma Hinton, means that we win repeat work from funder and borrower clients in this sector.

Transactions in the health and care sectors represent 30% of the transactions our banking and finance team acts on and a large percentage of these are private equity transactions. We are able to access expert lawyers from around the firm to provide commercially focused and relevant advice to help protect lenders into the sector considering the landscape of changing policy and regulation.

The independent healthcare team won the Private Legal Adviser Award at the LaingBuisson Awards in November 2021 which is a testament to our commitment and expertise in this area.

"Browne Jacobson has an experienced team with the ability to deal with the time constraints and demands of event-driven transactions."

Our banking and finance partner, Paul Hill, leads in this area and has strong connections and capability having advised on many of the largest and most complex national and international transactions in this sector. Coupled with the extensive experience of our energy, government, construction, public procurement and corporate teams, we offer clients a strong fully packaged service. We have an impressive workstream in this area, including advising on some of the highest profile infrastructure acquisitions in the UK market.

Real estate finance (both development and investment finance) is a large part of our practice which is headed up by Mark Lewis.

Mark and his team are dedicated solely to real estate finance so are able to offer very tailored and practical advice. Recently, we’ve been particularly active on funding transactions in the residential housing sector including for Homes England and Wise Living. Homes England are a key client, and we advise nationally on its Home Building Fund which provides development finance into the residential housebuilding sector.

We also act for a large number of retailers (including Boots, Morrisons and 99p stores), niche retailers, luxury brands, designer labels and cosmetics companies on a variety of matters including real estate, property portfolio management and property and corporate acquisitions.

The team have carved out a niche advising on hotel transactions – and as a result have very strong and up-to-date understanding of the key issues affecting funding in this sector, including banks’ approach to hotel funding (i.e. profitability focus over LTV), overseas buyers, franchise agreements and non-disturbance agreements.

"A highly personable team. Enjoyable to work alongside whilst also carrying out work in a professional and highly competent manner. Communicate well throughout a transaction and the depth of team means that there is always someone to pick up work to meet tight timescales when required."

We regularly advise on acquisitions, cash-out transactions, development capital financings, project finance and private equity transactions. We also have an impressive client base in this sector which gives us strong visibility of the local market.

We have genuine depth of experience in acting on private equity transactions for banks, private equity houses and management teams completing numerous recent high-profile deals. We work closely alongside our market-leading private equity specialists to deliver these transactions with a true understanding of the market in which our clients operate. We are well known for our commercial and pragmatic advice and our added value derived from the wealth of our deal experience. We were named Regional Legal Adviser of the Year at the 2021 European Private Equity Awards.

Featured experience

HSBC UK Bank Plc

Advising HSBC UK Bank Plc on its funding of the acquisition of the Cecil Jones group by leading national pharmacy group, Knights Chemist.

Cooper Parry

Advised the partners of leading accountancy firm Cooper Parry on the agreement for Dutch based firm Waterland Private Equity, to invest in the business.

Boost & Co

Advising Boost & Co on its significant funding to SML Group – an accredited land surveying firm – to support its acquisition strategy.

Beechbrook Capital

Advising Beechbrook Capital on its support of the investment by Owner Venture Managers in the Derbyshire-based roofing specialist business Permaroof/PermaGroup.

Testimonials

"They are always willing to go the extra mile, readily available, and willing to be commercial."

"Browne Jacobson's guidance is first rate."

"Browne Jacobson provide exceptional attention to detail and a solutions-oriented approach in creating bespoke and highly complex financing arrangements."

"The cross-collaboration between the banking team and the broader corporate team is seamless."

Key contacts

Shaun McCabe

Partner

Emma Hinton

Partner

Paul Ray

Partner

Graham Ball

Partner

Paul Hill

Partner

James Busby

Partner

Chereta Edmeade

Partner

Patrick Berry

Senior Associate