Aon has urged US lawmakers to establish a coordinated, whole government approach to artificial intelligence (AI) regulation, emphasising the need for a national policy framework that ensures insurability while promoting innovation.

This call came during testimony by Kevin Kalinich, Aon's Intangible Assets Global Collaboration Leader, before a government committee on 30 July 2025.

Rising AI risks and industry warnings

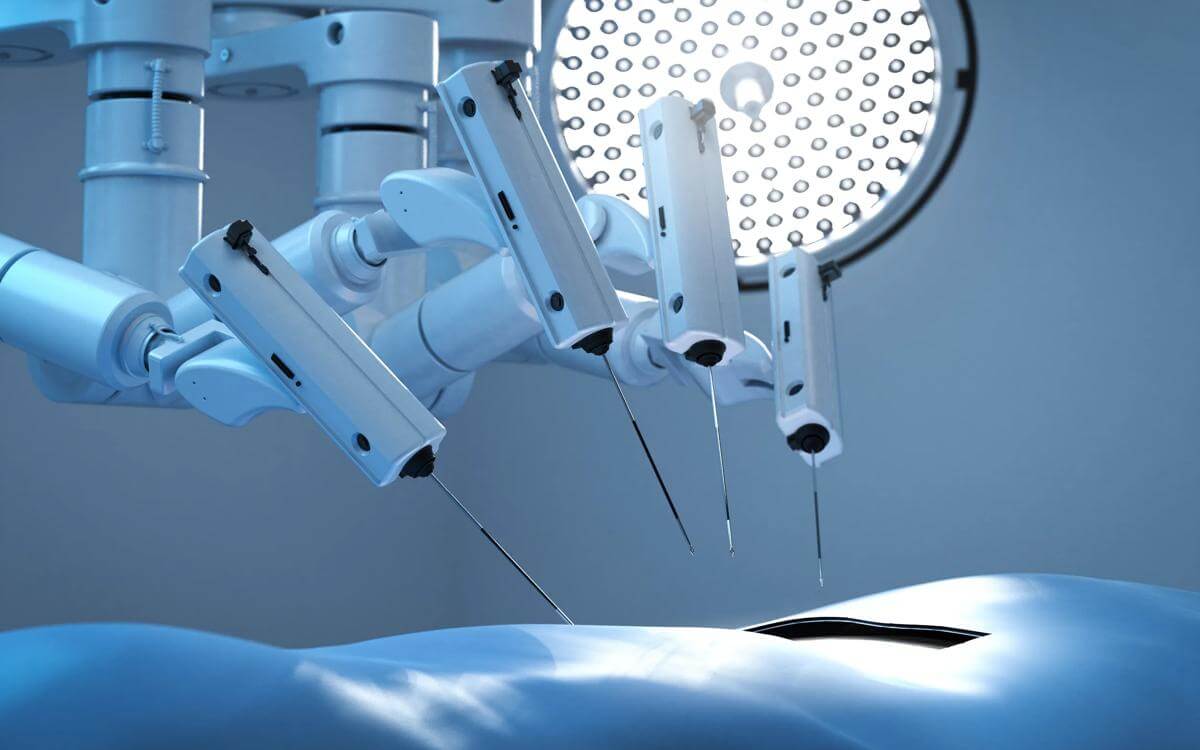

AI-related incidents have surged 56% year on year according to Stanford's 2025 AI Index Report. Identified risks include large language model hallucinations, AI cyber-attacks, deepfakes, intellectual property infringement, data leakage, AI 'washing', and robotic faults.

OpenAI CEO Sam Altman has warned that AI could disrupt labour markets and economic stability at an unprecedented pace.

Kalinich also highlighted that AI-induced systemic disruption poses significant insurability challenges. Traditional insurance models rely on uncorrelated, diversifiable risk pools, but AI-related risks could become correlated and systemic, creating "unquantifiable aggregate exposures" that are difficult to price and underwrite using existing structures.

Existing regulatory initiatives and policy recommendations

Aon supports building on existing initiatives like the National Association of Insurance Commissioners' model bulletin on AI use by insurers (adopted December 2023 and now implemented by over half of US states). Aon also endorses incorporating the bulletin's affirmative safety principles into a national framework, while allowing states to serve as innovation laboratories.

Aon supports public policy that establishes clear liability frameworks, maintains viable insurance markets, and enables developers and end users to operate with confidence.

Additionally, Aon encourages lawmakers to establish a national, principles-based framework for AI so that AI becomes "a force for good, guided by insight, trust, and shared responsibility”.

What does this mean for insurers?

For insurers, Aon's call for AI regulation signals both challenges and opportunities ahead. The insurance industry should prepare for fundamental shifts in risk assessment and underwriting as AI-related incidents may continue to surge.

While traditional insurance models clearly face disruption, the proposed national framework may offer insurers some regulatory clarity.

Contents

- The Word, August 2025

- Lutz v Ryanair: What does the latest case on agency workers mean for EPL insurers?

- Template binder update: Profit commission clauses

- Admiral sets aside £50m for customer compensation

- How geospatial data is becoming a crucial part of risk analysis: What this means for insurers

- Questions insurers should be asking about their clients' AI usage

- The Arbitration Act 2025: What does it mean for insurers?

Author

Mark Hickson

Head of Business Development

onlineteaminbox@brownejacobson.com

+44 (0)370 270 6000

Tim Johnson

Partner

tim.johnson@brownejacobson.com

+44 (0)115 976 6557