ESG for Beginners

As you probably know by now, the acronym 'ESG' stands for environmental, social and governance. Although the investment community initially coined the term, it has grown into a larger concept that can be applied more broadly to any business or practice.

Jeniz White is an associate at Browne Jacobson specialising in financial services and an Equality Diversity & Inclusion (EDI) consultant. In this article, Jeniz gives a beginner's introduction to ESG and what, in her perspective, is needed to become an ESG changemaker.

As you probably know by now, the acronym 'ESG' stands for environmental, social and governance. Although the investment community initially coined the term, it has grown into a larger concept that can be applied more broadly to any business or practice.

Social Consciousness – the ESG origin story

Individuals wanting to invest in funds or businesses that they consider to be ethical is not a new practice. There is, for instance, evidence in many key Abrahamic religious texts of teachings to influence commercial activity by reference to moral or ethical considerations or requirements. Such approaches often involved reducing the exploitation of fellow humans.

Skipping forward a few years (!) to the twentieth century, it is common practice for investors to refuse to invest in products like tobacco, arms, nuclear weapons, alcohol and gambling companies. In line with their religious origins, these investments are sometimes referred to as 'sin stocks'.

During the twentieth century, the use of the term 'social consciousness' has become prevalent. It, and phrases like it, have been deployed for different social and political purposes, and in some cases, they have been co-opted and are now widely used as pejoratives (e.g. 'woke').

However, the vocabulary of social consciousness has undoubtedly been deployed by multiple bodies as a 'force for good'.

'Consciousness' is a concept we're all familiar with – it is the state of being aware of and responsive to the things around us.

'Social' in this context refers to an awareness of the forms of community or aggregation in which individuals exist.

As such, social consciousness requires going beyond your feelings or the personal consequences of a situation, and instead, developing an awareness of the welfare of other individuals in society. It also requires finding a 'collective' way to solve a problem. It involves attempting to question, and develop an awareness of, the structural causes (e.g. the economic, political or philosophical foundations) of an issue, and wanting to pursue a solution that addresses those causes.

In short, its foundation lies in kindness. It is the ability to look beyond yourself, those closest to you or those that look like you. It is the ability and willingness to be concerned with and take responsibility for others. It is recognising and respecting their emotions, expressing empathy, compassion and understanding.

However, recognition and respect need practical manifestation. Without action, consciousness is merely theory. As a result, consciousness also requires actively participating in the development of society and taking ownership over its future by finding solutions to inequality that involve everyone. This requires businesses and governments to be at the forefront of change instead of placing the responsibility solely on the individuals who immediately face the symptoms of the structural causes.

Some of the general principles can be summarised as follows:

- wanting to create a world where people take more responsibility and ownership over for the imbalances in our societies and their individual and collective contribution to it;

- working towards tackling climate change for the benefit of everyone (i.e. not just particular high media profile countries or blocs);

- appreciating how these concerns and our systems alike are interconnected and have implications that reach beyond our immediate purview; and

- eradicating marginalisation and inequality.

More detailed articulations can be found at, for instance, THE 17 GOALS | Sustainable Development (un.org).

ESG & Investment

The acronym ESG was originally developed in the investment community. It refers to a set of criteria or standards that can apply to a company to assess;

- its impact on the environment;

- its impact on society;

- how the company is organised and governs itself;

- its managers

- its owners; and

- others who may control or influence its functioning.

ESG factors are typically used by socially conscious investors who seek to invest in a company that aligns with their values. This is sometimes referred to as 'socially responsible investing', i.e. investments that are considered ethical because of the nature of the business the company conducts or where the company has good 'social value'.

Many firms, funds, and other investments advertise a specialist focus on environmentally or socially responsible investing. According to Morningstar, in the first quarter of 2021, inflows into European “sustainable” funds are reported as totalling many billions of euros. While there are – or appear to be - a range of financial products and services that have been created to ensure better ESG outcomes, many investors, analysts, regulators and other observers have material concerns that the actual composition and performance of certain products do not live up to the stated (or implied) intentions for the products. This mismatch is called 'greenwashing'. The UN, the 'Conference of Parties' and Net-Zero.

At the United Nations climate change conference (COP) in 2015, each country in attendance committed to working together to limit global warming to less than 2 degrees below pre-Western Europe /Northern Atlantic economies' industrialisation levels (see Defining 'pre-industrial' | Climate Lab Book), with the aim of reaching 1.5 degrees below. One of COP's missions is to mobilise finance to help deliver this goal. This involves ensuring that developed countries dedicate $100 billion every year in climate finance to support developing countries.

The UN predicts that $ trillions in private finance will be needed to get us to 'net-zero'. This is where the amount of greenhouse gasses going into the atmosphere are balanced by the removal of them from the atmosphere. To achieve this, they suggest that every financial decision needs to take climate into account, including:

- all private investment decisions, but also all spending decisions that countries and international financial institutions are making as they roll out stimulus packages to rebuild economies from the Covid pandemic;

- Companies being transparent about the risks and opportunities that climate change, and the transition to a net-zero economy, pose to their business;

- Central banks and regulators making sure that our financial systems can withstand the impacts of climate change and support the transition to net-zero; and

- Banks, insurers, investors and other financial firms committing to ensuring their investments, underwriting and lending are aligned with net-zero.

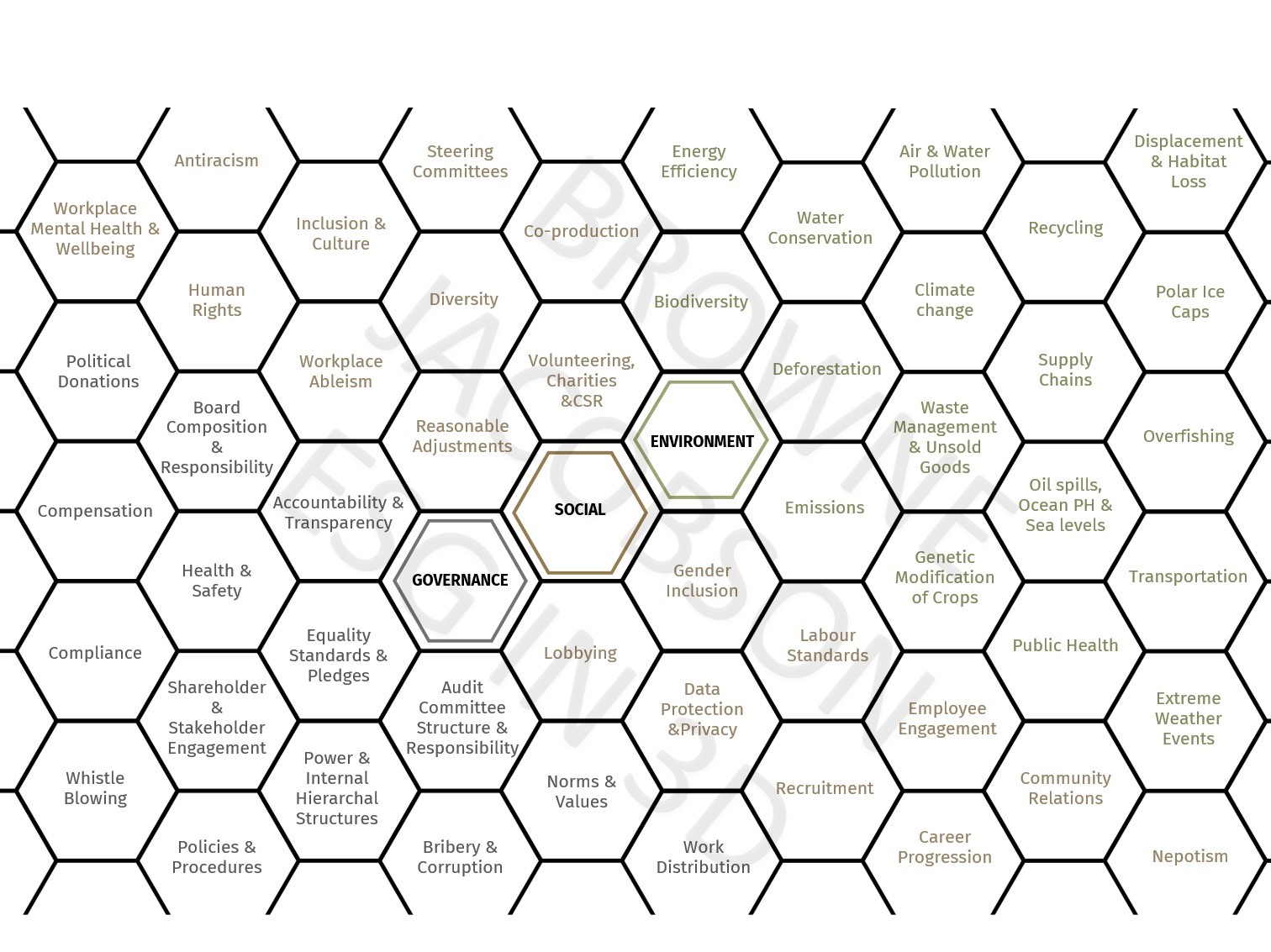

However, reaching net zero tackles only one part or 'dimension' of ESG. It is our belief, and common sense would suggest, that to truly serve the interests of global society, a much wider set of goals are required. For more on this subject, keep an eye out for our upcoming article titled 'Two’s company, thre-ESG – why ESG must be considered in unison'. In the meantime, the matrix below highlights some of the key sub-categories or strands of ESG.

Contact

Mark Hickson

Head of Business Development

onlineteaminbox@brownejacobson.com

+44 (0)370 270 6000