Commercial lawyers

Our experienced commercial lawyers will ensure that you are getting the most out of your commercial law negotiations and contracts. We’ll include protections, which are tailored to the needs of your business, to reflect how your business operates in practice and manage your legal risk effectively.

Commercial law covers a wide range of legal issues, including drafting and reviewing contracts, advising on regulatory compliance, managing mergers and acquisitions, resolving disputes, and protecting intellectual property. Our commercial lawyers ensure that transactions are legally sound and aligned with your interests, helping you navigate the complex landscape of commercial law efficiently and effectively.

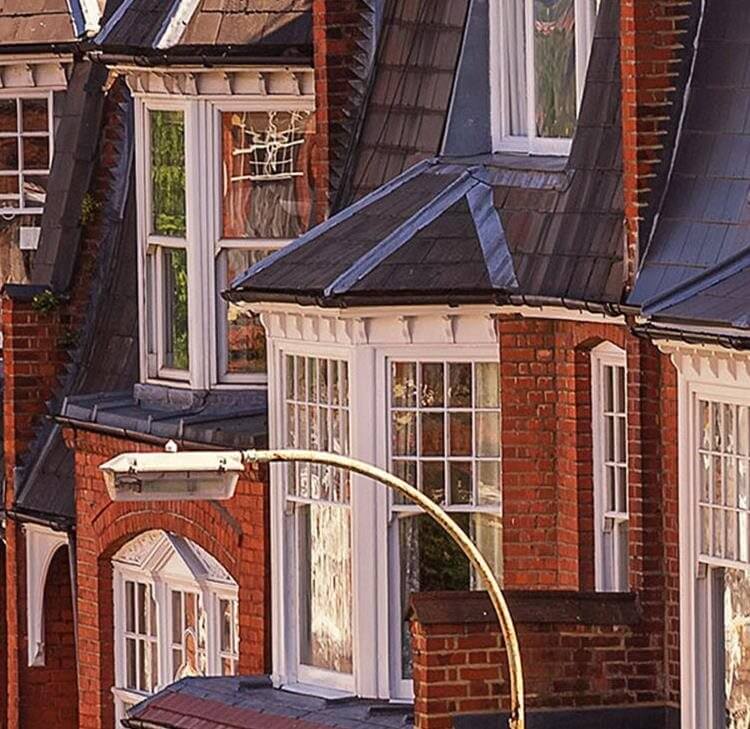

We represent a wide range of clients, from startups to well-known brands, both in the UK and internationally. Key industries include:

- construction and real estate,

- energy and infrastructure,

- financial services and insurance,

- manufacturing and industrials,

- retail, consumer and logistics, and

- technology.

We are a full-service commercial law firm. Whether you are engaged in a business transformation project or putting a business as usual agreement in place we can support you on a wide range of commercial contracts.

Commercial law services

Amongst our many commerical law services, we have the know-how to help with:

- supply,

- manufacturing and logistics,

- joint ventures and collaborations,

- complex digital and sourcing,

- agency and distribution,

- franchising,

- international trade and commerce,

- antitrust and competition law, and

- consumer and e-commerce.

Our commercial lawyers include experts in data protection law, antitrust and competition law, and other forms of regulation applicable to commercial contracts meaning you can be assured that your agreements will balance your commercial objectives with adherence to the relevant regulatory requirements.

This diverse experience enables us to provide targeted legal advice across various industries.

Most importantly, we forge strong relationships with our clients, guiding you to the right solution with ease and confidence.

"The team were highly professional, attentive and precise with advice, next steps, ad hoc support, and actions taken. The service was available when I needed it, responsive, and accurate and exceeded my expectations in all regards."

Featured experience

A European manufacturer

Advised on the digital transformation and e-commerce arrangements with resellers on partnerships aimed at supplying car parts direct to the public.

A financial service provider

Advising on the co-branding of a credit card partnership between two leading financial services brands. We advised on the contractual arrangement and IP issues and negotiated the agreement on behalf of our client.

A leading food brand

Advising on various long term complex distribution agreements involving multiple parties, including regulatory advice.

A logistics and warehousing provider

Advised a logistics company on the structuring of its arrangements. This included warehousing arrangements and competition law advice.

Testimonials

"Very high level of legal expertise in an assortment of different areas. Ability to relate this legal knowledge to the commercial practicalities of our business. Personable working style resulting in their feeling like a part of our team."

"Their astute legal knowledge alongside their engaging personalities make them easy to work with."

Related expertise

Key contacts

Richard Nicholas

Partner

Emma Roake

Partner

Cat Driscoll

Partner

Jeanne Kelly

Partner

Nick Smee

Partner

Alex Mason

Partner

Joe Davis

Principal Associate

Rowan Armstrong

Partner

Kulpreet Virdi

Senior Associate

Duncan McMeekin

Legal Director

Testimonials

“We find Browne Jacobson a delight to work with. They are easy and transparent to deal with, provide a broad range of legal services and are highly responsive.”