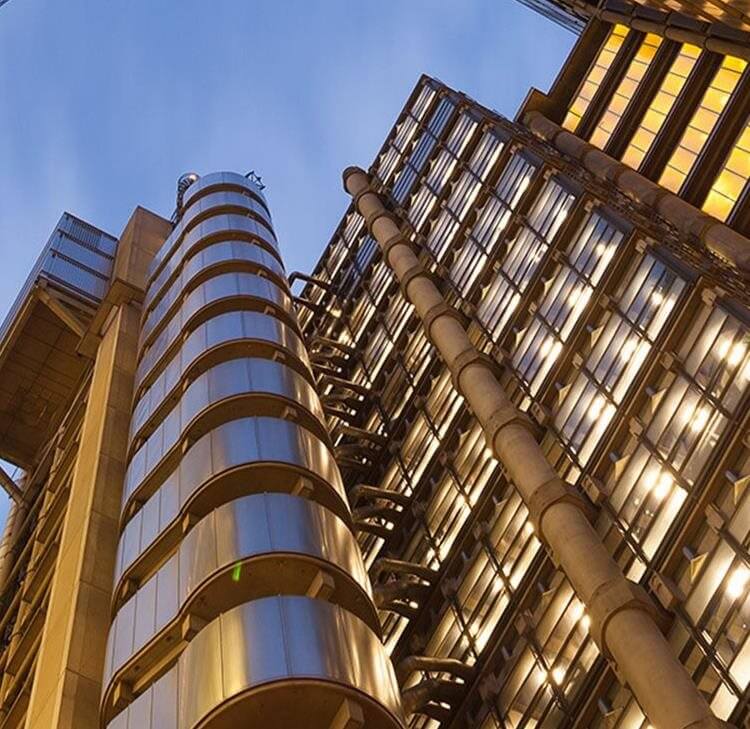

The FCA’s strategy for 2025-2030, published in March last year, emphasises building trust in markets, encouraging innovation and protecting consumers.

For UK subsidiaries and branches of overseas banks, these priorities translate into concrete regulatory changes and expectations. Below we highlight the FCA’s anticipated priorities for 2026 and discuss how they will affect overseas banks’ UK operations.

Regulatory reform and market access

One major theme is regulatory reform to boost UK competitiveness post-Brexit. The UK government’s Smarter Regulatory Framework is underway – replacing retained EU financial regulations with UK-specific rules. Throughout 2026, the FCA will continue rolling out new rules under the Financial Services and Markets Act 2023, including updates to MiFID II-derived requirements and simplified reporting obligations.

For UK entities of overseas banks, regulatory divergence means carefully tracking UK-specific standards that may differ from EU or home-country rules. A practical upside is improved market access: the UK’s new Overseas Recognition Regime and recent financial services agreements (such as with Switzerland) point to a more open-door policy for international business.

These steps benefit overseas-headquartered banks by reducing regulatory friction, though they come with expectations of close cooperation with UK regulators. UK entities of overseas banks should ensure their compliance functions are prepared for evolving UK rules and reporting demands.

Governance, accountability and culture

The FCA remains committed to strong governance and individual accountability. However, 2026 may bring streamlining of the Senior Managers and Certification Regime (SMCR). The FCA and PRA are reviewing SMCR requirements with the aim of reducing unnecessary regulatory burden while preserving accountability.

Potential areas of refinement under consideration include simplified approval processes and reduced duplication in documentation requirements. For UK entities of overseas banks, any simplification will be welcome, though the core principle stands: senior managers must maintain effective oversight and will be held to account for misconduct or control failings.

Culture is another explicit focus. The FCA has made clear that serious non-financial misconduct – such as workplace harassment or bullying – can indicate poor culture and pose regulatory concerns. Under new rules taking effect on 1 September 2026, serious non-financial misconduct can constitute a breach of the Conduct

Rules for individuals in firms subject to SMCR, supported by FCA guidance explaining how firms should interpret and apply these standards. Overseas banks must ensure their group culture and HR policies align with UK expectations of integrity and respect. The FCA will expect firms to foster healthy, accountable cultures and will not hesitate to sanction firms or managers when governance breaks down.

Consumer protection and retail conduct

Strengthening consumer protection is at the heart of the FCA’s agenda. The Consumer Duty, which took effect in 2023, is expected to be a focal point of FCA supervision and enforcement in 2026. UK entities of overseas banks engaging with retail or small business clients should be ready for scrutiny of their products and communications.

The FCA will ask: Does your product truly meet customer needs? Are fees and terms fair and clearly explained? Are customer support channels effective?

Several specific retail market reforms are also on the horizon. By 15 July 2026, Buy-Now-Pay-Later (BNPL) credit products (officially termed “deferred payment credit”) will be brought into the FCA’s regulatory perimeter. New rules are expected to impose requirements around creditworthiness, affordability checks, appropriate information provision and consumer protections such as complaints handling.

Additionally, HM Treasury’s ongoing review of the Consumer Credit Act 1974 is expected to lead to a modernised consumer credit regime affecting banks and other lenders involved in UK consumer lending.

The FCA has demonstrated a willingness to intervene aggressively to protect consumers. A recent example is the proposed industry-wide redress scheme for mis-sold motor finance, which – if implemented as currently drafted – could require lenders across the sector to pay billions of pounds to in compensation to affected customers.

The broader message is clear: the FCA will push entire markets to make amends if customers have been harmed. All firms with UK retail products should proactively review past business for any risks of mis-selling or unfair treatment.

Sustainable finance and ESG

Environmental, social and governance (ESG) matters remain a high priority. The FCA is now actively policing ESG claims and disclosures to prevent greenwashing. Under the Sustainability Disclosure Requirements (SDR) regime, the FCA’s anti-greenwashing rule came into force on 31 May 2024 and requires that sustainability-related statements by FCA-authorised firms are clear, fair and not misleading.

In 2026, we can expect the FCA to enforce this rule vigorously. UK entities of overseas banks should review all public communications about ESG credentials or “green” products to ensure they are substantiated.

Under SDR, large UK asset managers and asset owners will need to publish detailed sustainability disclosures on their strategies, risks and performance – with the largest firms required to report by December 2025 and other firms with £5 billion or more in assets under management by December 2026. Banks that manage assets or offer investment products should assess whether these rules apply to them.

In parallel, regulators and Government are developing standards for corporate sustainability and transition plan disclosures. Overseas banks with public net-zero commitments should be prepared for increasing scrutiny of the credibility and detail of their transition planning.

Financial crime and enforcement

Combatting financial crime remains a high priority for UK authorities, with fresh developments expected in 2026. HM Treasury has published draft, targeted amendments to the Money Laundering Regulations that are expected to come into force in early 2026.

These proposed updates aim to address evolving risks in the anti-money laundering/counter-terrorist financing regime, including enhanced oversight of crypto-asset businesses, strengthened customer due diligence and inter-agency information-sharing. UK entities of overseas banks should begin assessing the potential implications for their compliance frameworks.

A significant legal change is the new corporate offence of “failure to prevent fraud”, which came into force on 1 September 2025. Under this law, large companies (including banks and other large organisations that meet specified size criteria) can be held criminally liable if they lack reasonable measures to prevent fraud by their employees, agents or other associated persons that benefit the organisation, unless they can demonstrate that appropriate fraud prevention procedures were in place.

In 2026, we may see the first enforcement of this offence. UK entities of overseas banks should review their systems and controls to ensure they have strong anti-fraud frameworks – including whistleblowing channels, transaction monitoring and clear management accountability for fraud risk.

The FCA will continue its uncompromising stance on market abuse. Moreover, the regulatory perimeter is expanding: new rules will bring crypto currency trading and lending into the scope of regulation, including the application of market abuse laws to crypto assets. For any overseas bank involved with digital assets, this means that such activities will soon be subject to the same market integrity rules as traditional securities.

The enforcement climate is noteworthy. The FCA has been working to accelerate its enforcement investigations and to take more immediate action when it spots harm. This proactive approach will continue in 2026. For UK entities of overseas banks, any compliance lapses could prompt swift intervention. The FCA’s expectation is that firms 'get it right first time' – and if they do not, the regulator is now quicker to intervene.

Innovation: Crypto, FinTech and data

The FCA is eager to support innovation whilst managing risk. A prime area of focus is crypto assets and digital finance.

By 2026, the UK will have a new regulatory framework for crypto trading platforms, exchanges and custodians. The FCA has consulted on rules for crypto firms covering consumer protection, prudential standards and operational resilience. From 2026 onwards, any firm operating a crypto exchange or offering crypto services in the UK will need to be authorised and meet robust standards.

Payments innovation is another area to watch. The Bank of England and the FCA are laying the groundwork to regulate stablecoins used as payment methods. If a banking group plans to integrate or use stablecoins for faster cross-border transactions, it should be aware that regulatory standards are forthcoming.

Additionally, the FCA is keeping a close eye on the use of artificial intelligence (AI) in financial services. While no specific AI regulations are in place yet, the regulator has emphasised the need for firms to manage potential risks such as algorithmic bias and the explainability of AI-driven decisions. In 2026, we expect further guidance on AI governance in finance.

Conclusion

The year 2026 promises to be dynamic for financial regulation in the UK. The FCA’s priorities – from regulatory reform and consumer protection to ESG, financial crime and innovation – reflect its overarching goal of a trusted, competitive and resilient financial sector. UK subsidiaries and branches of overseas banks should take these signals seriously.

Now is the time to assess compliance and risk management frameworks against the coming changes. By proactively adapting to new rules, reinforcing good conduct and culture, and embracing innovation responsibly, contact our team to discuss how overseas banks can not only meet FCA expectations but also gain a competitive edge in a rapidly evolving regulatory landscape.

Contents

- Horizon scanning: FCA's anticipated priorities for 2026

- FCA’s anticipated priorities relating to enforcement and investigations

- FCA’s anticipated priorities for wealth and asset managers

- FCA’s anticipated priorities for the insurance market

- FCA’s anticipated priorities for authorised funds

- FCA’s anticipated priorities for banks

- FCA’s anticipated priorities for building societies

- FCA’s anticipated priorities for insurance brokers and intermediaries

- FCA's anticipated priorities for InsurTechs

- FCA's anticipated priorities for FinTechs

Key contacts

Jeremy Irving

Partner

Helen Simm

Partner

Tom Murrell

Associate

You may be interested in...

Legal Update

Horizon scanning: FCA's anticipated priorities for 2026

Legal Update

FCA’s anticipated priorities for building societies

Legal Update

FCA’s anticipated priorities for banks

Legal Update

FCA's priorities for overseas banks’ UK subsidiaries and branches

Legal Update

FCA’s anticipated priorities for wealth and asset managers

Legal Update

FCA’s anticipated priorities relating to enforcement and investigations

Legal Update

FCA fines Nationwide £44m for financial crime control failings: Key lessons for firms

Legal Update

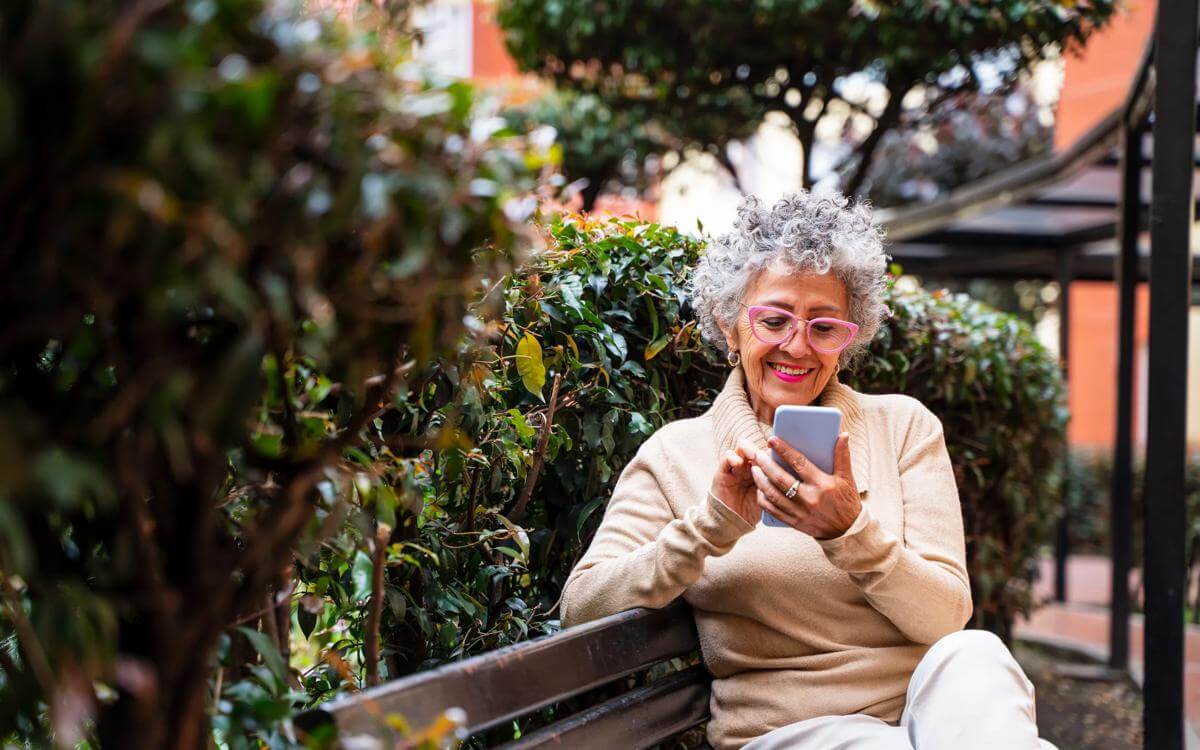

Later life lending: Meeting the evolving needs of an ageing borrower base

Legal Update

Current state and outlook for the mortgage lending sector

Legal Update

Banking transaction update: July 2025

Legal Update

PuFin takes flight: Homes England launches new bank

Guide

Overview of the European Accessibility Act 2025 in Ireland

Published Article

Lessons in sustainability reporting: The FRC on CFDs

Legal Update

Fortifying the future: A strategic blueprint for elevating UK defence investment and support

Legal Update - DORA

EU Digital Operational Resilience Act: Countdown to comply with the January 2025 deadline

Legal Update

The European Accessibility Act: Inclusive products and services

Legal Update

Banking Transaction Update — May 2024

Legal Update

The EU AI Act: What does it mean for insurers?

Published Article - Consumer Duty

How ‘operational resilience’ enables compliance with the ‘consumer duty’ and ‘vulnerable customers’

Legal Update

Customers in financial difficulty: Cost of living crisis and the FCA

Legal Update - Consumer Duty

Insurance industry Consumer Duty update – Fair value, FCA Dear CEO letters and multi-occupancy buildings

Legal Update

Making numbers easy - complying with the Customer Understanding objective

Legal Update

Banking Transaction Updates - July 2023

Published Article

Three peaks of consumer protection: Part two — intolerable harm

Published Article - Consumer Duty

The three peaks of customer protection: How ‘operational resilience’ enables compliance with the ‘Consumer Duty’ and ‘Vulnerable Customers’

Published Article - Consumer Duty

Consumer duty part 3 - 'The drill-down' into the 'cross-cutting' rules

Published Article

Starling Bank employment tribunal

The outcome of the Employment Tribunal claim brought by Gulnaz Raja against Starling Bank Limited (1) (Starling), and Matthew Newman (2) was reported last month.

Published Article

EU banks show slow progress on gender diversity

Legal Update

Investors groups are calling for action from the Government

Legal Update

The FCA’s anti-greenwash proposals

Legal Update

Lloyds becomes first UK bank to halt new oil and gas funding

Legal Update

Environmental Act 2021 – statutory requirement to submit targets not complied with

Legal Update

The Starling Bank disability discrimination decision

Legal Update

FCA Financial Lives survey: Socio- demographics and financial vulnerability

Legal Update

Disability and access in banking

Legal Update

Progress report on climate-related disclosures

Legal Update

Five “takeaways” in claims against mortgage brokers following Taylor v Legal & General Partnership Services Ltd [2022] EWHC 2475 (Ch)

Claims arising from interest-only mortgages have been farmed in volume. Many such claims to date have sought to drive a narrative that interest-only mortgages are an inherently toxic product and brokers were negligent simply for suggesting them. Taylor is a helpful recalibration, focussing instead on what the monies raised by the mortgage product were being used for and whether the client understood the inherent risks.