Beauty Industry - Plastic Packaging Tax

The war on plastic is being taken to a new level, and businesses that don’t consider sourcing recycled packaging materials could face costly implications.

The war on plastic is being taken to a new level, and businesses that don’t consider sourcing recycled packaging materials could face costly implications.

The Government’s complicated new plastic packaging tax, which applies from 1 April 2022, provides another reason to start looking at alternative packaging materials. Current demand for those materials is however causing price rises and potentially deterring the switch. If you need to include certain information about your products on your packaging by law, you now need to balance the legal, financial, and environmental implications.

The Government has issued detailed guidance, which can be found here: Plastic Packaging Tax.

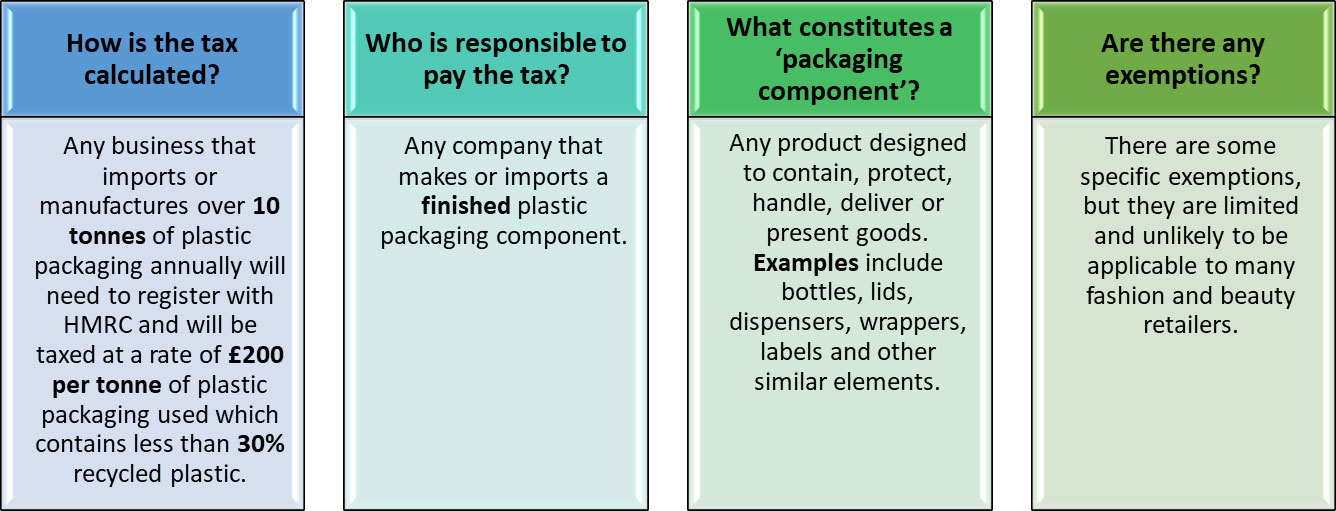

Diagram of how plastic tax is calculated

What should you be doing?

To comply with the law, you should:

- Submit quarterly tax returns, providing detailed information regarding your use of plastic packaging (all businesses that meet the threshold for registration will need to do so, regardless of whether any tax is due under the new rules).

- Put in place training, systems, and processes to ensure that you can adapt to the new requirements.

- Review your existing contractual arrangements to determine if they have the flexibility to consider any changes to the tax and allow for an appropriate level of monitoring to ensure compliance with the new rules. If not, consider varying the agreements to take these requirements into account.

- Ensure all new contracts contain appropriate rights and obligations to guarantee and monitor compliance with the rules and that the pricing mechanisms take account of any associated costs.

The new rules also mean that you can be held responsible if you know or should have known that a company in your supply chain has failed to pay the tax due. Lots of businesses are re-evaluating their supply chains at the moment and an added level of due diligence should be built in to that process. Brands will need to be clear about what materials are used in the packaging of products and who in the supply chain is responsible for payment of the associated tax.

The Government has also issued detailed guidance around the level of due diligence that brands should consider, which can be found here: How to make due diligence checks for Plastic Packaging Tax.

Alongside increased consumer scrutiny of brands’ green practices, the new measures will likely continue to drive businesses to consider alternative materials to plastic packaging.

This in turn is driving up the price of alternative materials, to the extent where some businesses are left to consider whether it would be more cost-effective to simply accept the tax and continue with business as usual. The concern is that this will lead to substantial price increases, effectively passing the cost of the new tax to the consumer. Some businesses have taken steps to reduce the amount of packaging they use altogether, including M&S who recently stopped providing hangers with orders for underwear (which would be considered packaging under the new regulations) in an attempt to reduce plastic waste.

Smaller businesses that are less able to adapt are also likely to be disproportionately affected by the administrative burden that comes with the new rules. Larger businesses may have the resources and capability to introduce monitoring and reporting systems required to document the use and production of plastic packaging, while for some businesses, this will require a major operational overhaul.

When the single-use plastic carrier bag charge was first introduced in the UK in 2015, the initial concern was that smaller retailers would struggle to meet their administrative obligations under the regulations. However, the measures have seen retailers’ use of single-use carrier bags drop by around 97% since they were introduced. The UK Government will be hoping that this new measure has a similar effect and encourages businesses to move away from non-recycled plastic packaging, while not proving to be too much of an administrative challenge for businesses of all sizes.

Innovation and collaboration across industries are likely to be the most effective way that brands can work together to move towards alternative materials while making sure manufacturers and suppliers are making recycled plastics and alternatives available at a competitive price. Such collaboration has already been seen in certain industries - towards the end of last year Henkle, L’Oreal, LVMH, Natura & Co and Unilever announced the launch of an industry-wide environmental scoring system for cosmetic products aimed at creating greater transparency around the environmental impact of goods.

Further collaborations of this nature which incentivise manufacturers to use less virgin plastic in packaging products and reduce some of the administrative burden associated with carrying out supply chain-wide due diligence are likely to be one of the most effective ways brands may come together to minimise the impact of the tax.

The impact on the fashion and beauty industries

Both the fashion and beauty industries have traditionally been heavily reliant on plastics and, as acknowledged by the British Beauty Council, the rules will pose a real challenge to producers and manufacturers. Aside from the general shortage of recycled plastics available across all industries, the beauty industry may also face difficulty adapting to the new rules due to other regulatory requirements that beauty brands are already subject to.

The EU Cosmetics Regulation sets out the labelling, packaging and safety requirements for cosmetic products being placed on the EU market. Following the end of the Brexit transition period, the regulations were retained in UK law in the form of the UK Cosmetics Regulation. There are various requirements under the regulation, including the need for brands to designate a ‘responsible person’ to ensure product safety and compliance. Brands selling in the EU and the UK will need to appoint a responsible person for both markets and identify that person on the labelling of their cosmetic products. There are also restrictions on the use of certain substances and nanomaterials in cosmetic products.

The Government is currently considering which laws and regulations retained following Brexit will continue to apply in the UK in the long term (including the Cosmetic Regulations). This may have an impact on the ongoing regulatory requirements of fashion and beauty brands, and is something brand owners should keep a close eye on.

With the regulatory landscape in the beauty industry continuing to change, it will be a challenge for brands to continue to comply and adapt. Despite progress concerning the recyclability of plastic materials, there are still doubts as to whether currently available plastic materials are of a high enough standard to meet the requirements to package cosmetic products under the Cosmetics Regulations.

Author

Faye McConnell

Principal Associate

faye.mcconnell@brownejacobson.com

+44(0)20 7871 8538