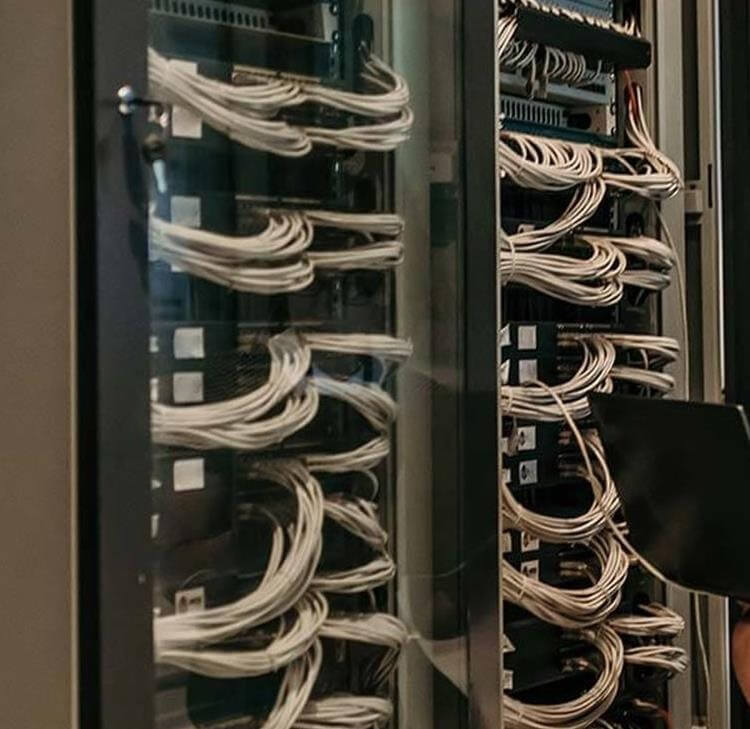

Data centres function as core infrastructure enablers of the technology sector. As Ireland continues to establish itself as a key technology hub in Europe, we are seeing a rapid demand for data centres.

Currently, there are over eighty data centres located in Ireland, with the majority located within Dublin.

The AI revolution has led to an explosion in data centre energy demand, with reports of a ChatGPT query consuming ten times more electricity than that of a Google search. Ireland has Europe’s highest national share of electricity usage attributed to data centres, with an estimated 21% of electricity consumed in the country being consumed by data centre operation (2023). The rate of demand for electricity in this sector is growing at a pace far exceeding that of the general economy, primarily due to the energy-intensive nature of the operation and cooling of data centres.

Our article outlines recent developments within the Irish data centre landscape and discusses the hurdles faced by the industry and action required to sustain future growth.

Key players in Ireland’s electricity grid landscape

In Ireland, the responsibility of developing our electricity network lies with our designated electricity System Operators (SOs). Eirgrid and ESB Networks act collectively as our designated SOs in Ireland. EirGrid acts as our transmission system (high voltage level) operator and ESB Networks as our distribution system operator (low to medium voltage level), connecting generators to the electricity system.

Separately, Ireland’s water and energy regulator, the Commission for Regulation of Utilities’ (the CRU) plays a distinct role in developing connection policy and ensuring stability of electricity supply.

CRU proposed decision on connection policy for Large Energy Users (LEUs)

The CRU recently published its new proposed decision paper on connection policy for LEUs, specifically data centres (the Proposed Decision). The Proposed Decision is the culmination of a nineteen-month review process, along with extensive stakeholder engagement.

The CRU previously published Decision Paper CRU/21/124 in response to constraints placed on the electricity grid by data centre connections. CRU/21/2124 established assessment criteria to be examined by SO’s in the consideration of new data centre applications to connect to the electricity network. The new Proposed Decision builds on the previous assessment criteria and seeks to supersede CRU 21/124, in advance of a State-led approach.

Key elements of the CRU’s Proposed Decision

The Proposed Decision sets out the following conditions for SOs to consider in relation to any new connection applications:

1. Location of application

It is to be considered whether the data centre application location is within a constrained or unconstrained region of the electricity market. Constraints on the electricity system arise where the network cannot deliver the electricity from where it is generated to where it is consumed.

The Proposed Decision requires SO’s to make information in relation to network capacity constraints readily accessible to any connection applicants. It is anticipated that some locations may not be available until the necessary grid reinforcements or upgrades are undertaken.

2. Treatment of onsite or proximate generation and storage

The data centre applicant’s ability to bring onsite or proximate dispatchable generation (and/or storage) capacity equal to or greater than their demand will also be considered.

The CRU is of the view that allowing data centres to connect to the electricity network without contributing to supply could pose a threat to the security of supply of electricity. The CRU recognises that it can be challenging in certain constrained locations to accommodate generation on the data centre site itself. Consequently, the Proposed Decision extends the radius to ‘proximate’ to the location of the site.

An additional requirement of the Proposed Decision is that any such electricity generation is to be subject to participation in the Irish wholesale electricity market, i.e. the Single Electricity Market.

3. Demand flexibility

The ability of the data centre to provide demand flexibility is also to be examined. This refers to the capability of a site to adjust its electricity usage based on grid conditions/signals.

This can be achieved through various methods such as shifting the timing of energy-intensive tasks (load-shifting) away from peak demand times, utilising onsite energy storage, or employing backup generation systems. These adjustments help balance the grid by reducing demand during peak times or supplying energy back to the grid when excess capacity is available.

The Proposed Decision does not mandate any additional demand flexibility provisions or onsite/ proximate demand generation for new connections but the SO’s can require specific provisions from data centres on a case-by-case basis.

4. Self-reporting of environmental emissions

Although the CRU does not currently have the legal basis to mandate specific emission reductions or offsetting conditions by data centres, the CRU can instead consider renewable energy policies and the promotion of such when developing electricity connection policies.

The Proposed Decision proposes to set an additional requirement for data centres to report to the relevant SO annually in relation to their overall emissions and utilisation of renewable energy (both directly and through Corporate Power Purchase Agreements).

The Proposed Decision notes that applications to the electricity grid will be subject to termination where the above criteria are not met.

Conclusion and wider framework

The consultation period in relation to the Proposed Decision has now concluded, with the informed decision expected to be published in later in the year.

As electricity demand from data centres in Ireland is projected to almost double within the next ten years, it is vital that data centres have clarity as to their ability to connect to the grid. It is critical that Ireland takes steps to accommodate technological advancement whilst also ensuring future energy stability and availability for both data centres and the general population alike.

It is important to also recognise the role that access to the grid forms as part of a wider framework of data centre development, and that in addition to power availability and grid connection challenges, there are other significant hurdles to data centre development and advancement in Ireland. For example:

- the availability of specialist contractors and their supply chains to construct data centres, often coming from outside of Ireland;

- planning permissions, and the delay, or denial of such permissions due to environmental issues;

- the availability of renewable energy sources (which themselves are subject to a variety of challenges due to similar issues such as planning permission as well as grid connection delays) to power data centres;

- land availability;

- the challenges faced in the data centre sector in terms of economic pressures related to investment costs;

- the need to keep up with rapidly advancing technology as well as emerging data hosting types such as colocation wholesale, and edge data centres.

Addressing these challenges requires a coordinated approach involving government bodies, industry stakeholders, and local communities to ensure that data centre construction is sustainable and beneficial for all parties involved, whilst maintaining growth within the data centre sector in Ireland which will be key to maintaining its position as a global leader for data centre investment and development. At present however, in the Dublin area for example, there is currently a hold on new data connections until 2028, and it is already falling behind other data centre markets in Europe. In monetary terms, the reduction in construction growth has been estimated at between €8bn - €10bn between now and 2028.

Contact

Paul Tohill

Legal Director

paul.tohill@brownejacobson.com

+353 1574 3928

Michael Sadler

Partner

michael.sadler@brownejacobson.com

+44 (0)115 976 6599